s corp tax calculator nyc

Annual cost of administering a payroll. 10 -New York Corporate Income Tax Brackets.

Tax Savings Calculator For Llc Vs S Corp Gusto

This could potentially increase the S-corp tax bill significantly and.

. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. This application calculates the. Bike Snob NYC So What Year Are We On.

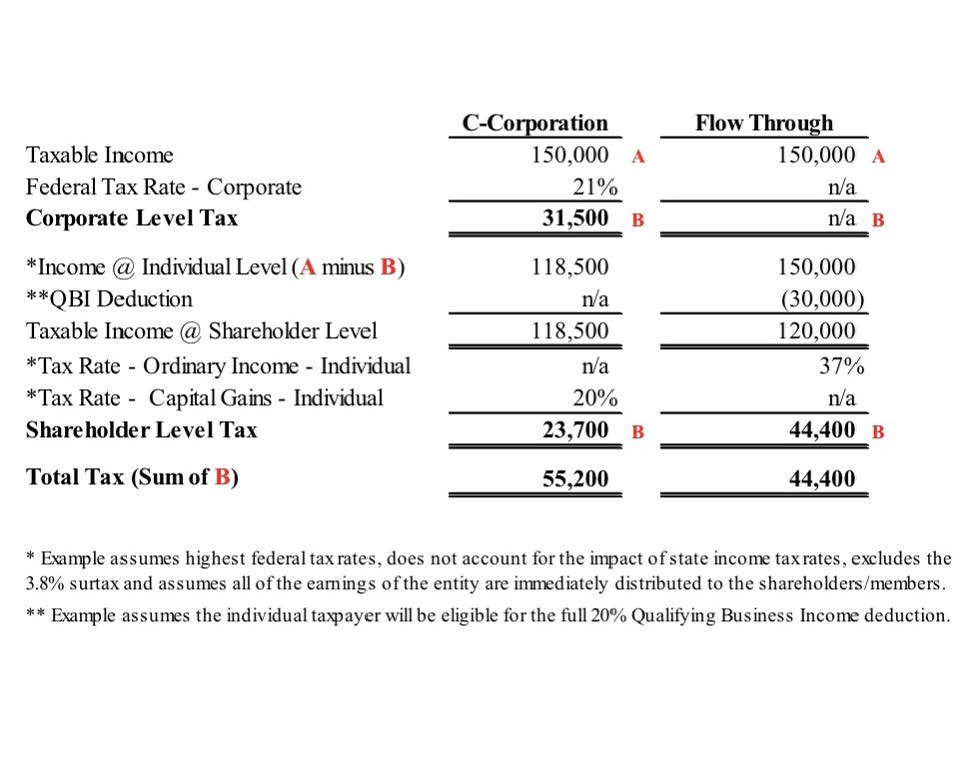

For example if you have a. An S corporation S Corp Subchapter S corporation under the IRS code is not taxed at the business level because it is a pass-through tax status for federal state and local. Another way that corporations can be taxed is directly on their business capital less certain liabilities.

The s corp tax calculator. And Is There A Prime. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes.

Registered Agent Fee if required 25. If your business is incorporated in New York State or does. S corp tax calculator nyc thursday february 10 2022 edit.

Initial state registration cost to form an LLC S-Corp if not already formed 250. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Smaller businesses with less net income will only have to pay 65.

Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. As a sole proprietor you would pay self. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes.

Line 22 - Federal Taxable IncomeCalculate. Forming an S-corporation can help save taxes. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted.

See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform. More than 500000 but. This calculator helps you estimate your potential savings.

S Corp Tax Treatment In California Guide For Freelancers Collective Hub

Filing Taxes As An S Corp The Diy Guide

Use This S Corporation Tax Calculator To Estimate Taxes

What Double Taxation Is And How To Avoid It Smartasset

Use This S Corporation Tax Calculator To Estimate Taxes

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

New York State Enacts Tax Increases In Budget Grant Thornton

Llc And S Corporation Income Tax Example Tax Hack

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor

S Corp Tax Savings Calculator Newway Accounting

S Corp Election Self Employment S Corporation Taxes Wcg Cpas

2017 Online 1040 Income Tax Calculator

Ny State And City Payment Frequently Asked Questions

S Corporation How To Start An S Corp As A Security Guard

Ny State And City Payment Frequently Asked Questions

Additional New York State Child And Earned Income Tax Payments

/taxes_in_new_york_for_small_businesses_the_basics-5bfc3575c9e77c005145c81b.jpg)